From the top—

What is a banking chatbot?

A banking chatbot is a virtual assistant powered by AI that engages visitors in a conversation across various channels. This software can interact with clients, answer various account-based questions, check balances, and notify the user of the upcoming due dates.

And how do banking chatbots work?

Banking chatbots use natural language processing and artificial intelligence to respond to inquiries from website visitors across different channels. These systems analyze the question, access the database, and offer the most relevant responses.

So, what platform to use for your bots?

Stick around to find out.

Without further ado—

Best AI solutions for banking

The banking sector has been undergoing a digital transformation for the last few years. AI chatbots and self-service options are becoming the norm for customer service, and institutions need to keep up to stay ahead of competitors.

But you can’t just choose any platform and be done with it. Banking services store sensitive information and have a great responsibility to the clients. That’s why we compiled a list of the top chatbots for banking.

Here’s a comparison table for you to take a quick look at the main aspects of all the platforms in this article:

| Platform | Rating | Free plan | Best for |

|---|---|---|---|

| Tidio | 4.7/5 ⭐️ | ✅ | Various chat triggers |

| TARS | 4.6/5 ⭐️ | ❌ | Banking-specific bot templates |

| IBM | 4.4/5 ⭐️ | ✅ | Sentiment analysis |

| Kasisto | N/A | ❌ | Multi-modal system |

| Haptik | 4.4/5 ⭐️ | ❌ | Robust analytics |

| Kore.ai | 4.7/5 ⭐️ | ❌ | NLP engines |

So, let’s review them in more detail.

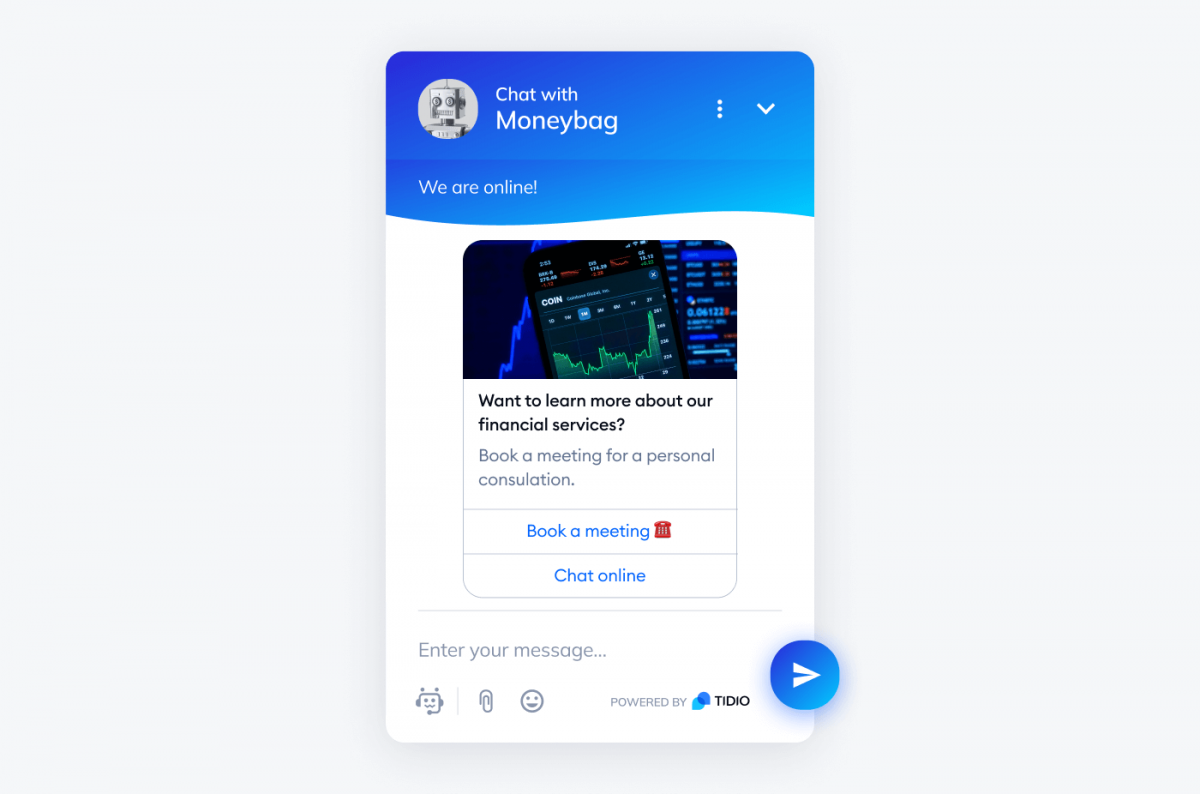

1. Tidio

Rating: 4.7/5 ⭐️ (1,520+ reviews)

Tidio is an all-in-one customer service platform that aims to boost sales and enhance customer support. At its core, Tidio offers powerful chatbots designed to elevate client engagement in real-time. These bots can also efficiently collect client information and be customized using a variety of templates to suit specific tasks.

While we’re proud of our comprehensive software, this blog isn’t the place for self-promotion. So, for more insights on Tidio, we invite you to read our reviews on G2. Additionally, you can experience our advanced conversational AI in banking yourself—completely free and with zero commitment.

Main features:

- More than 35 pre-designed templates

- Drag-and-drop visual chatbot builder

- Over 16 different chat triggers

- Mobile phone app available for iOS and Android

- Variety of integrations with ecommerce platforms and social media

Pricing:

- 7-day free trial available

- Free version available

- Starter ($29/mo)

- Growth (starts at $59/mo)

- Plus (starts at $749/mo)

- Premium (starts at $2999/mo)

Read more: Learn how to install Tidio on your website in a few simple steps.

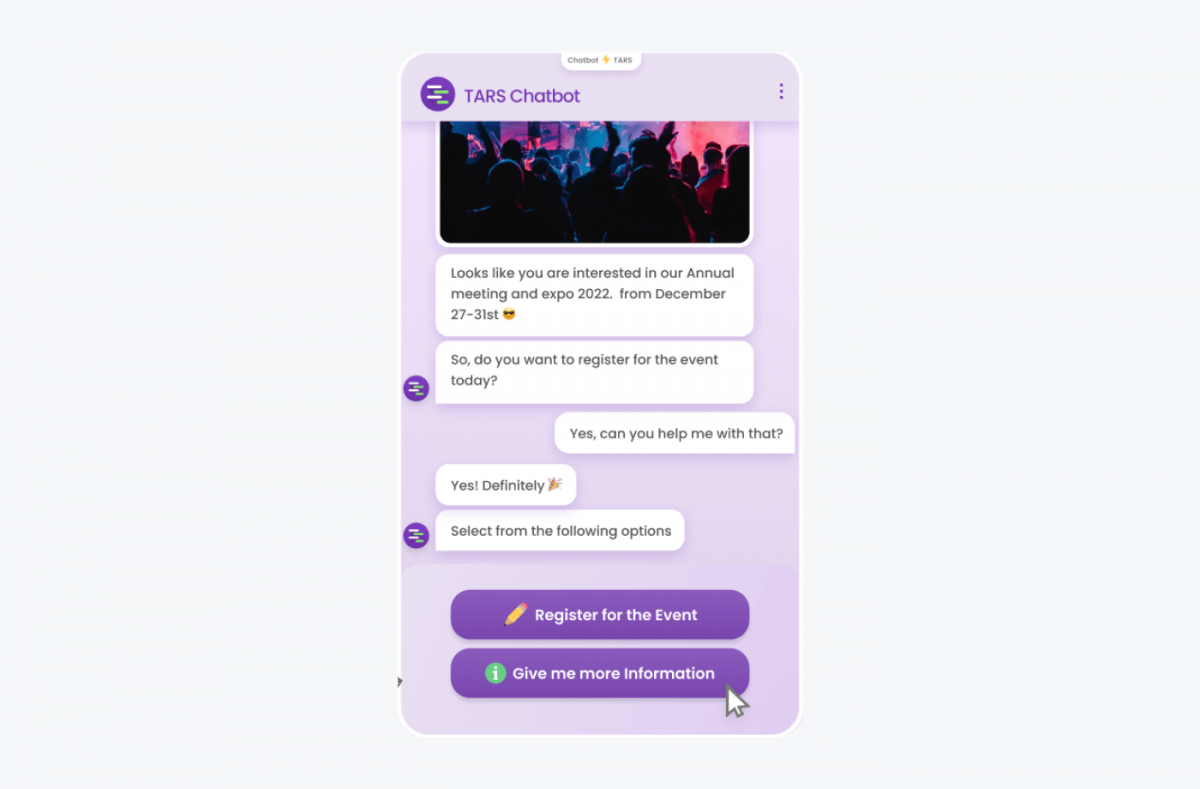

2. TARS

Rating: 4.6/5 ⭐️ (170+ reviews)

TARS can enhance your conversion funnels, improve the user experience, and automate various customer service interactions using their AI solutions for banking. When online visitors access your bank’s website, they’ll be greeted by a friendly, human-like interface that offers assistance, creating a more personal experience.

This banking chatbot is designed to provide relevant information about your financial services without overwhelming the user. TARS offers over 1,000 chatbot templates, including more than 320 specifically tailored for finance and banking. On top of that, you can deploy your natural language bank assistant as a chat widget on your web pages, as a standalone page on your site, or even on WhatsApp, ensuring versatility and convenience.

Pros:

- Industry-specific chatbot templates

- Geolocation data collection

- Simple configuration

Cons:

- Limited software customization

- Some users reported issues when connecting TARS to Google Analytics

- Contact sales team for pricing and demo

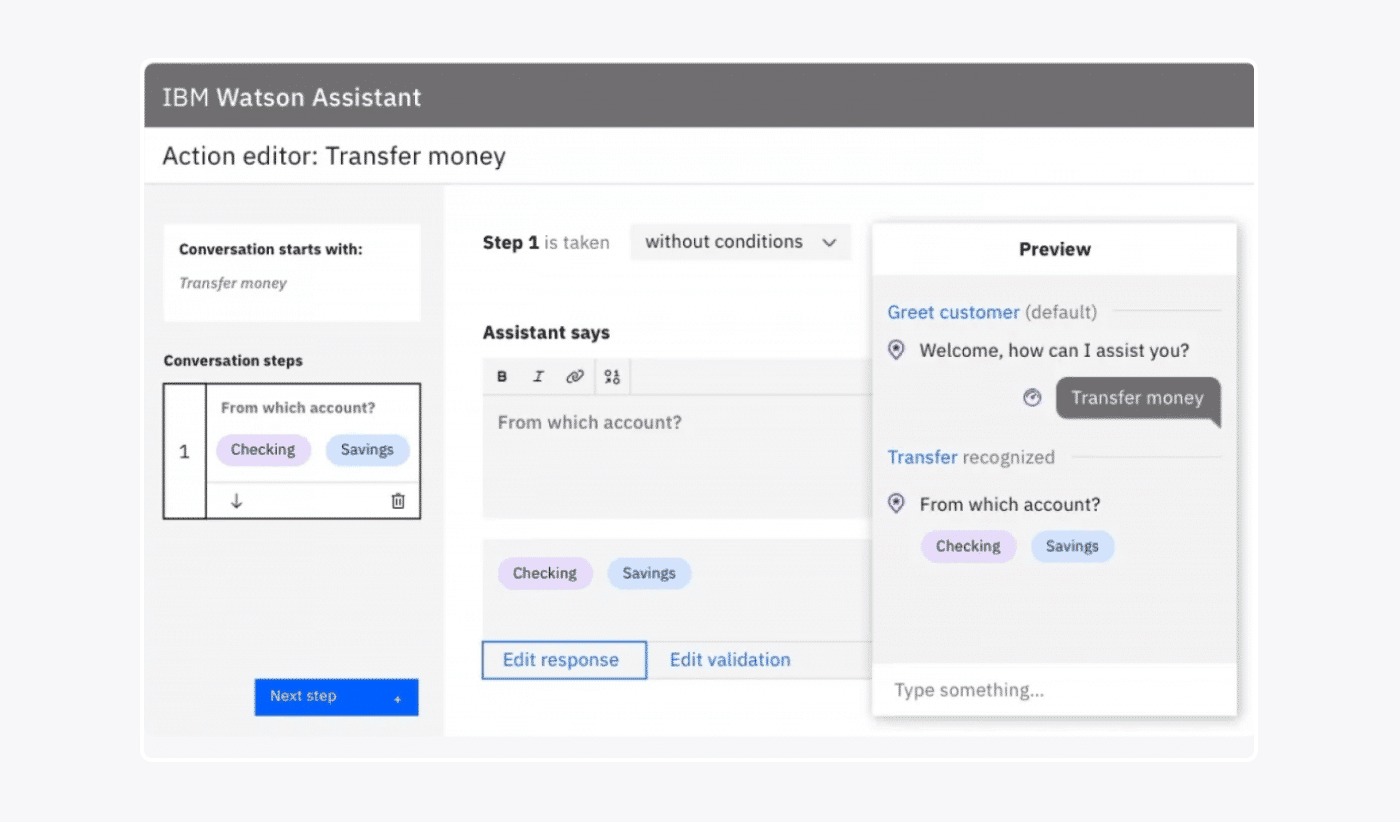

3. IBM Watson

Rating: 4.4/5 ⭐️ (290+ reviews)

Developers can leverage this banking virtual assistant to manage both simple and complex customer interactions within the financial sector. The company offers a cloud-based Natural Language Processing (NLP) service that seamlessly integrates structured data, such as customer databases, with unstructured data, like messages.

When it comes to security and privacy, this banking chatbot platform employs advanced measures for this critical aspect. These include visual recognition security and a private cloud solution for securely storing user data, ensuring the highest level of protection.

Pros:

- Customer sentiment analysis and predictive analytics

- Various custom categories classification

- Wide range of functionality from simple FAQ bots to powerful conversational AI systems using speech recognition

Cons:

- For full functionality you may need to integrate the software with additional tools

- Requires some technical knowledge

- Free conversational AI plan available

- Plus (from $140/mo)

- Enterprise → contact sales team

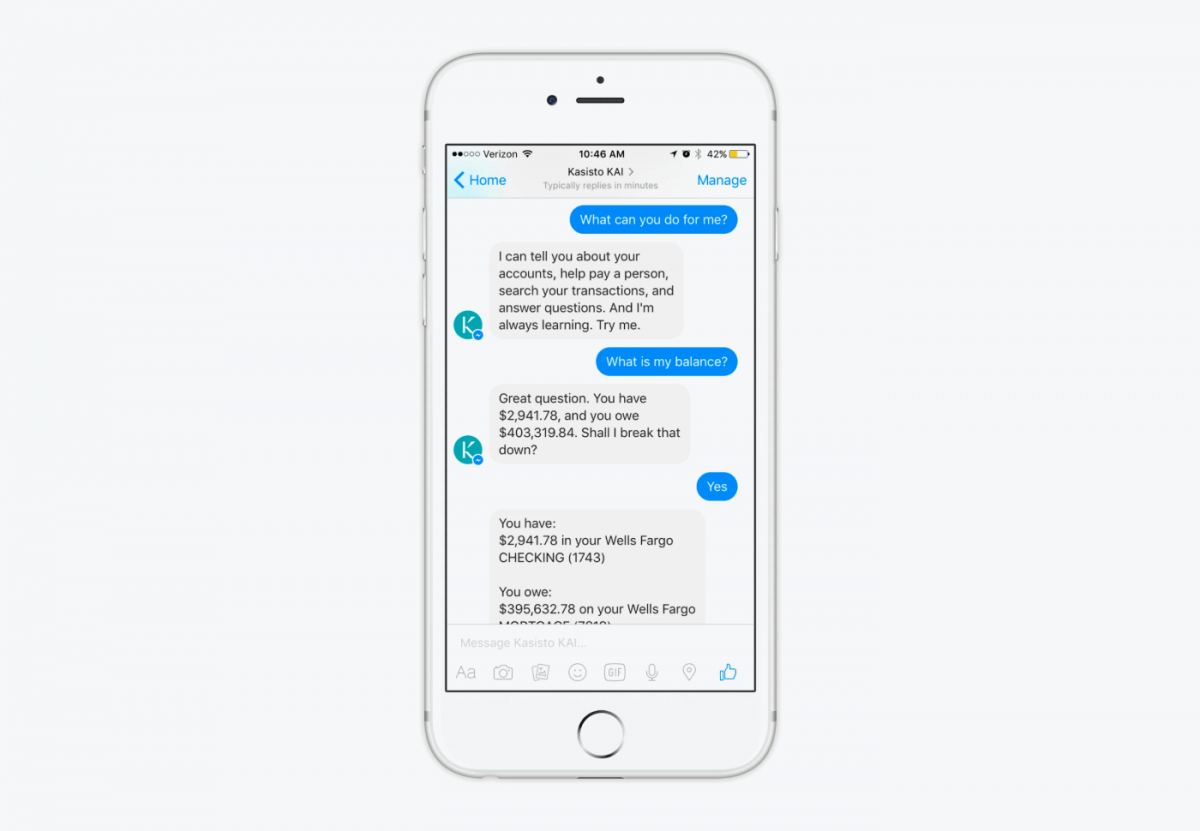

4. Kasisto

Rating: N/A

This banking chatbot stands out as one of the best in financial services. In today’s digital age, clients expect seamless digital engagement and a deep understanding of their needs from the service provider. To meet these expectations and attract new accounts, it’s crucial to perfect the digital customer experience.

With this advanced banking chatbot, you can offer on-demand support tailored to your clients’ needs. Kasisto uses sophisticated conversational AI and financial expertise to analyze account activity, generate insights, and provide recommendations that resolve common service requests. Additionally, the platform offers a multichannel experience and proactively delivers insights for future improvements.

Pros:

- Intent builder with responses, entities, and segments

- AI chatbot training and robust bot analytics

- Multi-modal software including text, touch, and voice commands

Cons:

- Occasional bugs in the system

- Some reviewers state miscommunication between different teams

- Contact sales team for pricing and demo

5. Haptik

Rating: 4.4/5 ⭐️ (140+ reviews)

Haptik offers a banking chatbot that empowers businesses to manage the entire customer lifecycle, from initial interest and purchase to ongoing support. By employing this virtual assistant, you can enhance operational efficiency and boost revenue for your financial institution. Designed with the user experience and consumer needs at its core, this AI banking bot facilitates better business decisions.

Using advanced technology, you can recreate the face-to-face experience for your customers. This software allows for personalized recommendations, buying guidance, and sharing of reviews from existing clients. The personalized approach helps your company to impress potential customers and increase the likelihood that they will choose your financial services over the competitors.

Pros:

- Robust analytics and reporting

- Fast customer support team

- Pre-defined chatbot processes

Cons:

- Limited guidelines provided on how to use Smart Agent Chat

- No real-time reports

- Contact sales team for pricing and demo

6. Kore.ai

Rating: 4.7/5 ⭐️ (310+ reviews)

Kore.ai was recognized as a leader in the 2023 Gartner Magic Quadrant for enterprise conversational AI platforms. This powerful AI for banking helps to enhance your finance and accounting efficiency by automating repetitive tasks with bots. The system streamlines critical tasks related to procurement and acquiring essential goods for your company’s operations.

As one of the best banking chatbots on the market, Kore.ai offers invoice processing and expense tracking with detailed reporting to improve money management for your clients. Additionally, Kore.ai serves as a conversational AI banking assistant, providing customers with balance notifications and bill reminders to help them stay on top of their finances.

Pros:

- Visual chatbot builder with drag-and-drop interface

- Three NLP chatbot engines: fundamental meaning (FM), machine learning (ML), knowledge graph (KG)

- Over 30 integrations including WhatsApp, Telegram, Facebook, and Twilio

Cons:

- Limited reports and analytics

- Chat and session management need improvements

- Free trial available

- Paid plans → contact sale team

Read more: Check out the top finance AI chatbots available on the market and choose the best one for your business.

Since you know the best platforms now, let’s go through examples of bank bots in practice.

Banking chatbot examples

Chatbot technology helps users with self-service and boosts lead generation for the business. Some of the chatbot use cases in banking include checking the client’s bank account and savings account, providing product details, and ensuring fraud prevention.

Here are five real-life banking chatbot examples in more detail:

1. Account information and transactions

Banking AI chatbots can securely access customers’ account information and transaction history by integrating with the bank’s core systems.

Through natural language processing, the chatbot can understand queries related to account balances, transaction details, and fund transfers. It can also retrieve the relevant info from the backend systems and present it to the customer in a conversational format.

A few actions you can perform using a virtual assistant for banking include:

- Checking account balances and transaction history

- Transferring funds between accounts

- Paying bills and managing recurring payments

- Locating nearby ATMs or bank branches

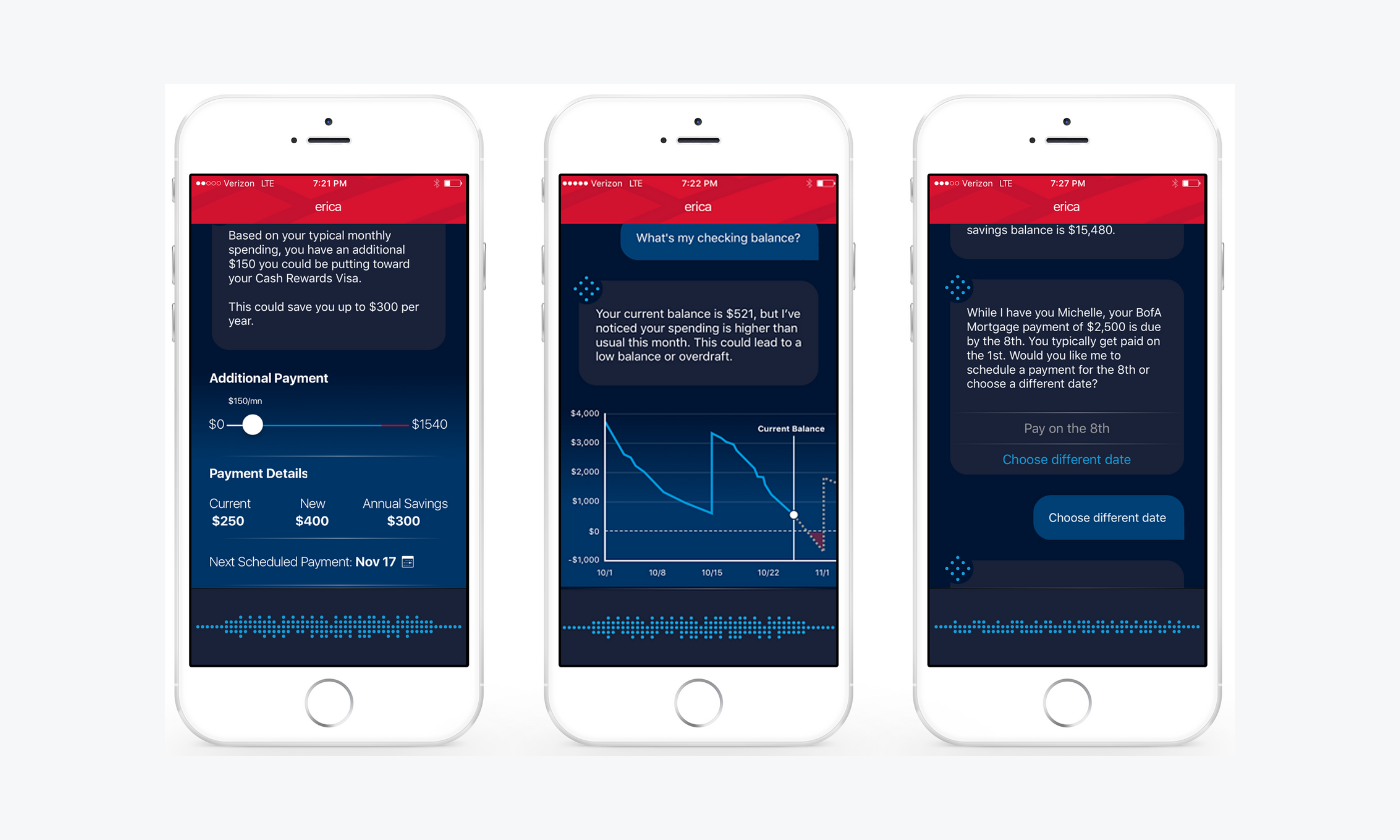

A real-life example of a banking chatbot that checks account data and transactions is Bank of America’s virtual assistant Erica.

Erica is Bank of America’s AI-powered digital assistant that helps customers with various banking tasks. These include checking account balances, transferring funds, paying bills, and providing insights into their spending patterns.

Did you know that…

About 61% of bank customers interact with their bank on digital channels on a weekly basis.

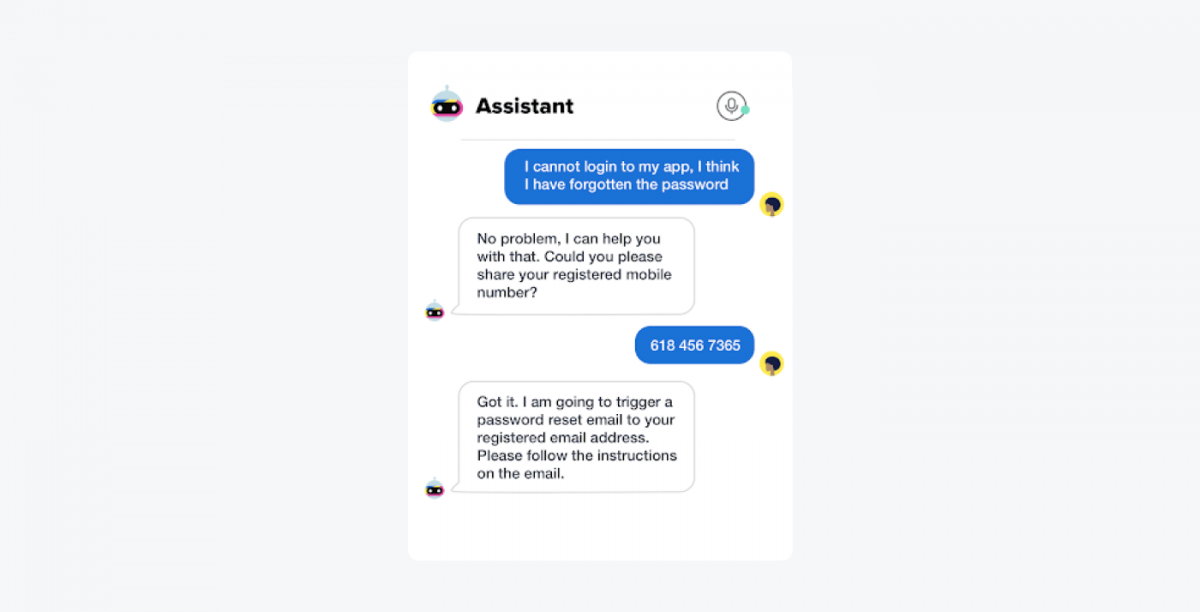

2. Customer service and support

AI chatbots in banking are trained on a vast knowledge base that includes data about the bank’s financial products, services, policies, and frequently asked questions. When a customer reaches out with a query or issue, the chatbot’s natural language processing capabilities enable it to understand the context and provide relevant information or solutions.

If the query is more complex or requires human intervention, the intelligent virtual assistant can seamlessly hand off the conversation to a human agent, ensuring a smooth customer experience.

Using this type of chatbot for your support service allows you to:

- Answer frequently asked questions about banking products and services

- Provide information on fees, charges, and account policies

- Assist with troubleshooting issues or resolving complaints

- Guide customers through account opening or loan application processes

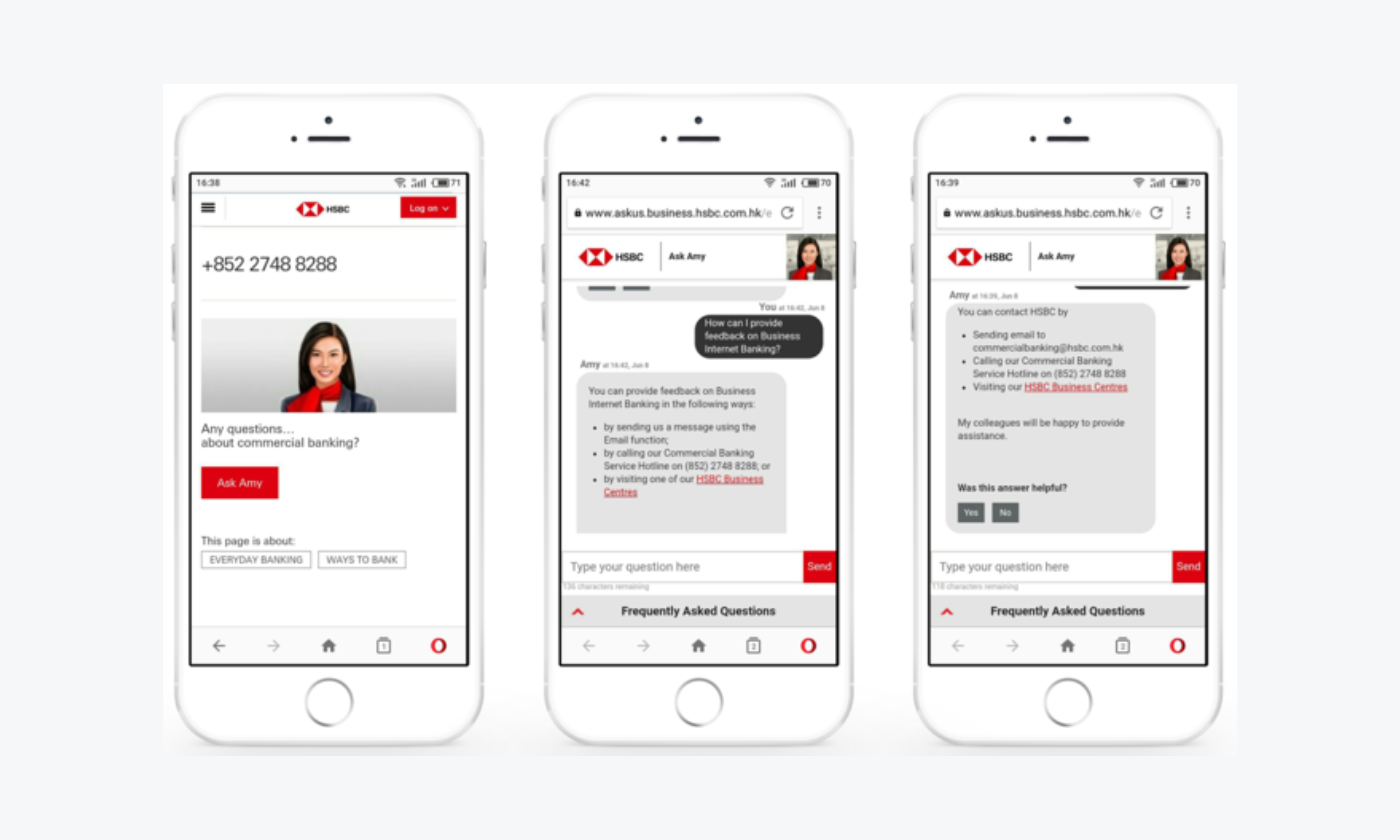

An example of a chatbot in banking that offers support is HSBC’s Amy.

This bot assists customers with tasks like checking account balances, viewing transaction history, and finding nearby ATM locations. It can also provide information about products and services offered by the bank.

Read more: Learn how Endeksa boosted lead generation with Tidio.

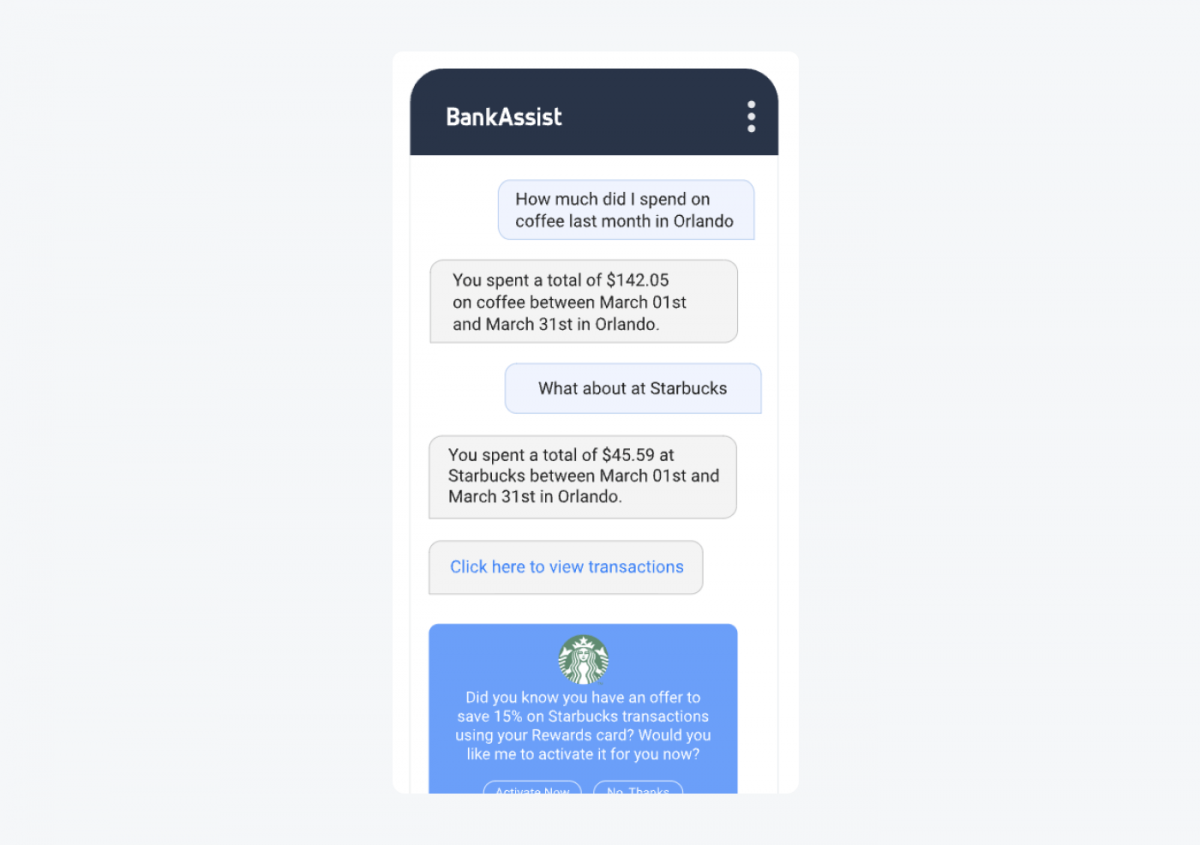

3. Personalized financial management

By analyzing customers’ transaction data and spending patterns, banking chatbots can provide personalized financial insights and recommendations. Also, using machine learning algorithms, the chatbot can identify areas where the customer may be overspending, suggest ways to cut costs, and recommend appropriate savings or investment options. On top of that, the chatbot can help customers set up budgets, track their progress, and adjust their financial plans as needed.

Here are a few tasks this bot can perform:

- Analyzing spending patterns and provide insights into expenses

- Offering personalized financial advice and recommendations

- Setting up budgets and savings goals

- Tracking investments and provide portfolio updates

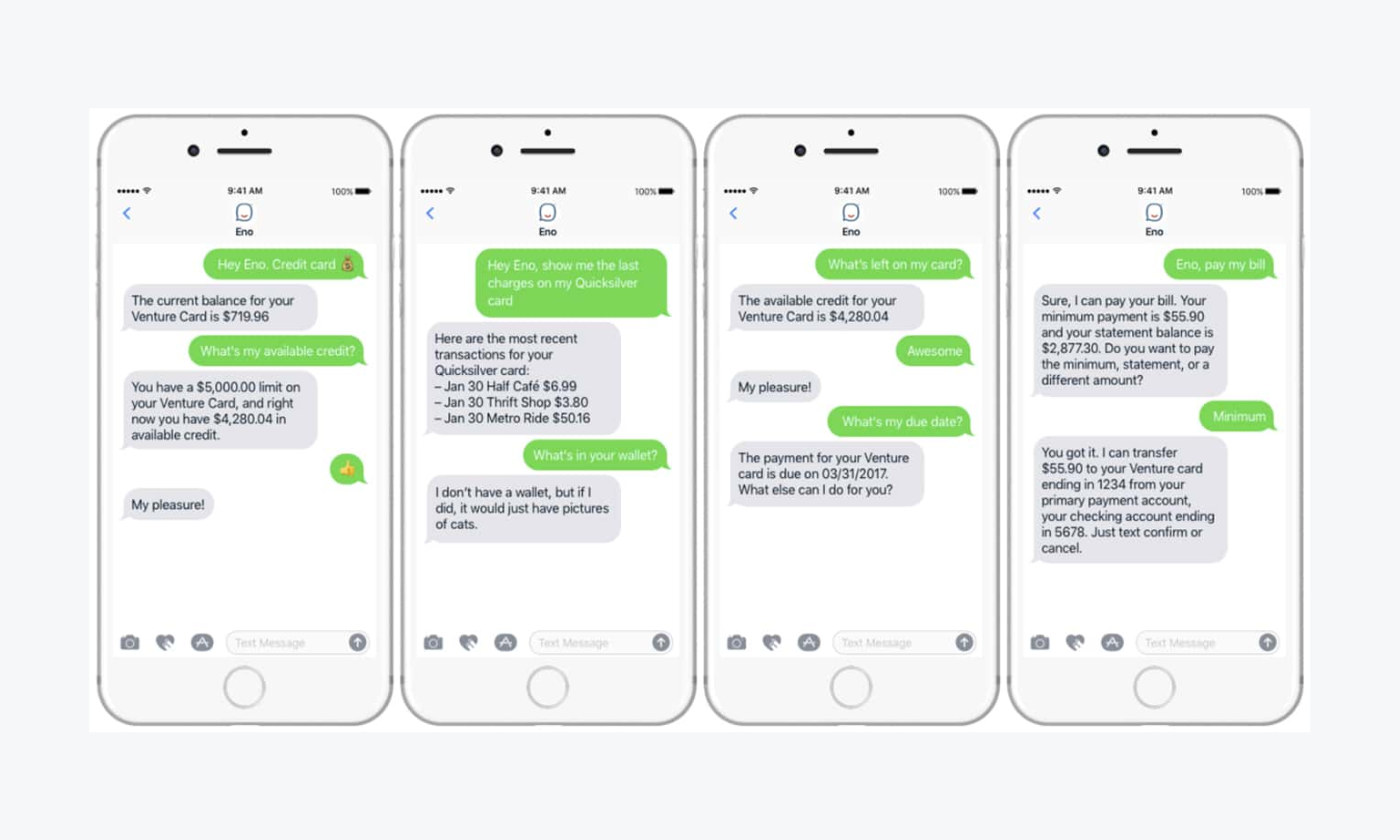

Capital One’s Eno virtual assistant is the perfect example here.

This bot helps customers with tasks like checking account balances, paying bills, and tracking their spending. It can also provide personalized insights and recommendations based on the customer’s financial behavior.

Did you know that…

One of the benefits of AI in banking is higher sales thanks to increased personalization. In fact, studies found that over 90% of marketers state that personalization contributes to business profitability.

4. Product information and sales

Banking chatbots can act as virtual sales assistants, providing customers with detailed information about the bank’s product offerings, such as loans, credit cards, mortgages, and investment plans.

Through conversational interactions, the chatbot can understand the customer’s specific needs and preferences, compare different product options, and guide the users through the application process. Additionally, the chatbot can cross-sell or upsell relevant products based on the customer’s profile and financial situation.

Here are examples of what this chatbot for banking can do:

- Provide guidance about banking products (loans, credit cards, mortgages) and investment options, including types of alternative investments

- Assist with product comparisons and help customers choose the right product

- Guide customers through the application process for new products

- Cross-sell and upsell relevant products based on customer needs

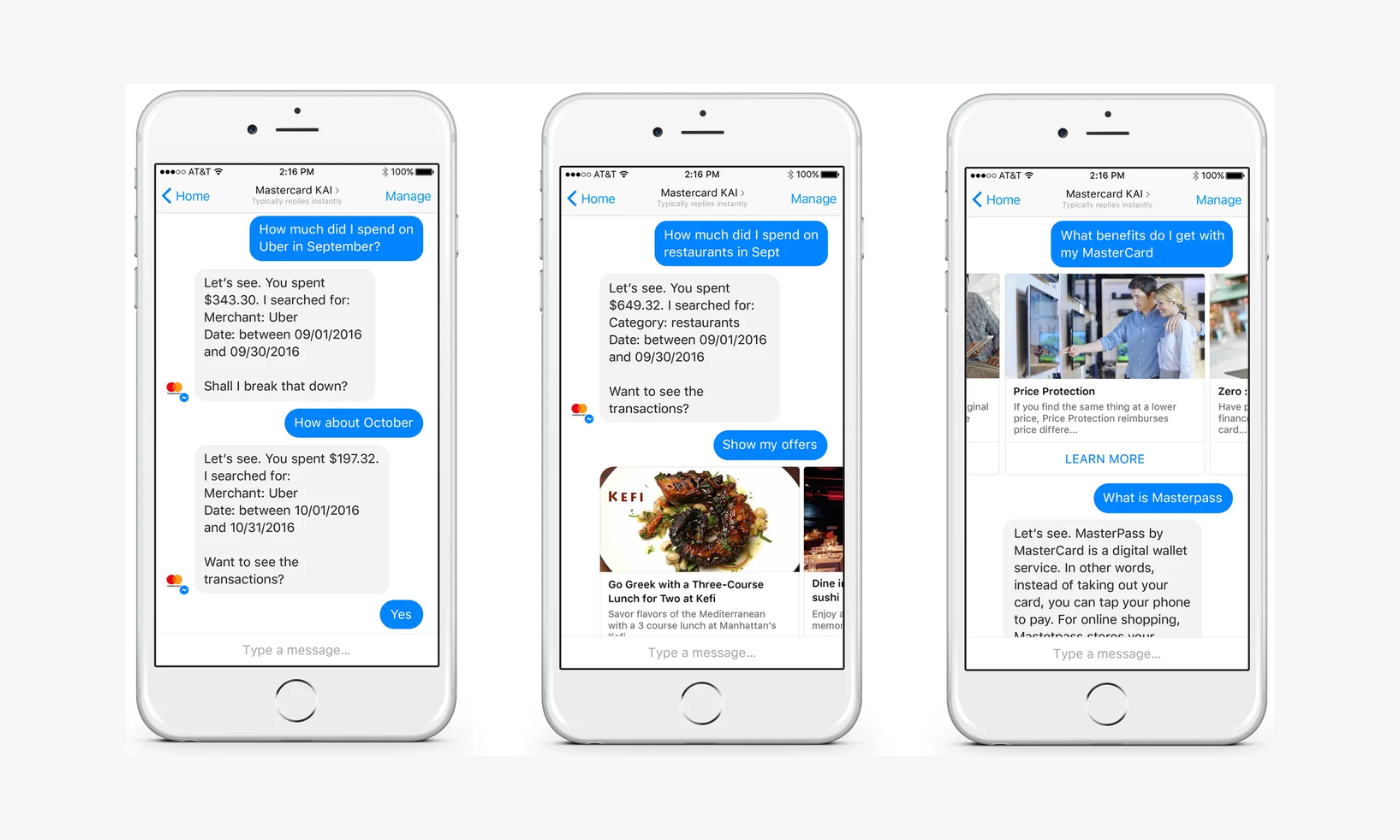

One example of this use case is Mastercard’s chatbot.

This AI-powered virtual assistant can assist customers with various banking tasks, such as checking account balances, making payments, and understanding their credit scores.

5. Security and fraud prevention

To ensure customer security and prevent fraudulent activities, banking chatbots can implement various authentication methods. These include biometric verification, one-time passwords, and security questions.

The chatbot can also monitor customer accounts for suspicious activities and alert clients in real-time. If a user reports a lost or stolen card, the chatbot can immediately initiate the necessary steps to deactivate the card and minimize potential fraud. Furthermore, the chatbot can perform fraud detection processes and provide customers with cybersecurity best practices and tips to protect their personal and financial data.

Here are a couple functionalities this AI for banks can do:

- Verify customer identity through secure authentication methods

- Alert customers about potential fraudulent activities on their accounts

- Assist with reporting lost or stolen cards

- Provide guidance on cybersecurity best practices

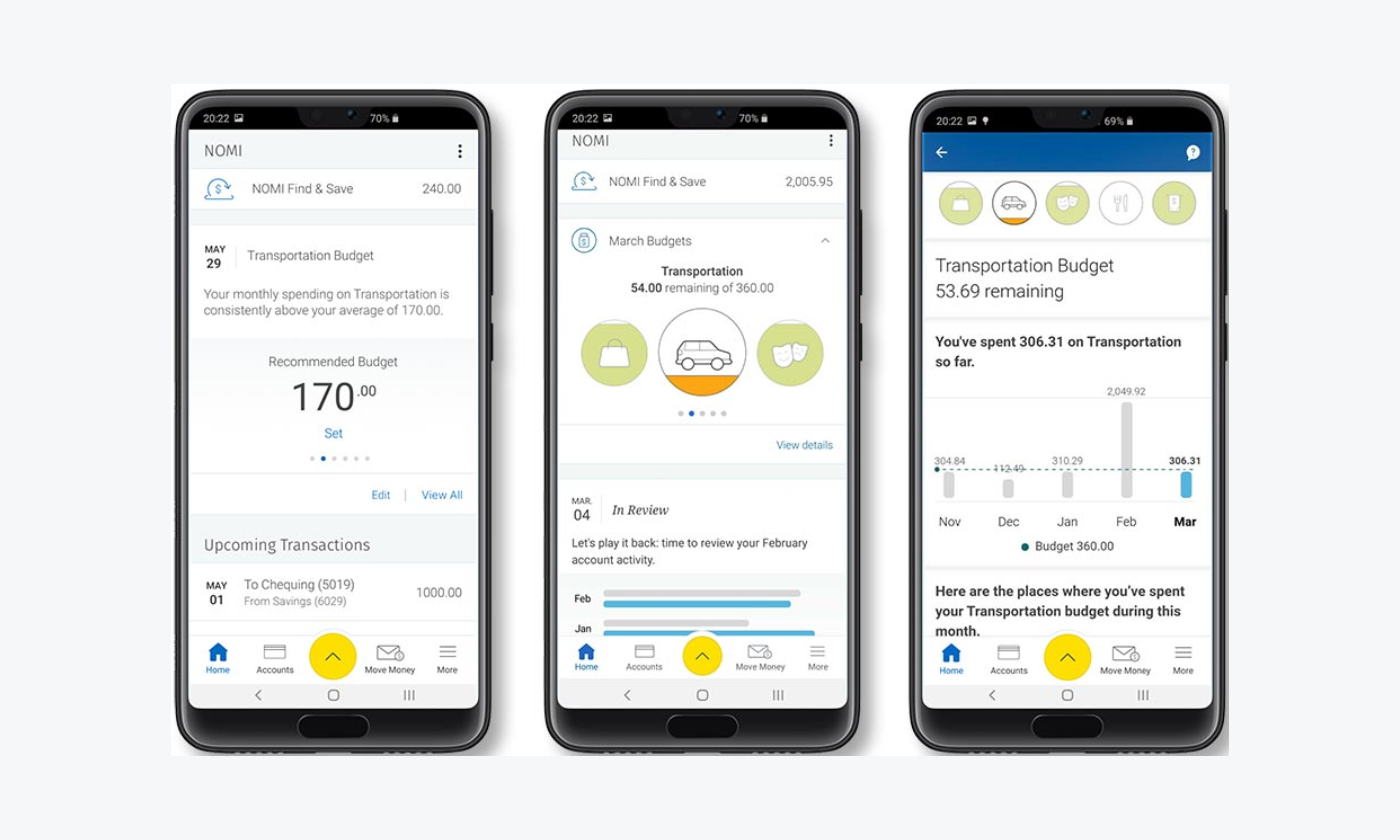

Royal Bank of Canada’s Nomi is another great example of an AI chatbot for banks.

This virtual assistant helps customers with tasks like checking account balances, transferring funds, and providing insights into their spending habits and financial goals.

Did you know that…

Danske Bank partnered with Teradata and found that using AI and machine learning for fraud detection resulted in a 50% reduction in false positives and a 60% improvement in fraud detection rates.

By leveraging natural language processing, machine learning, and seamless integration with banking systems, chatbots can enhance the overall customer experience, improve operational efficiency, and offer personalized financial services to customers.

Now—

What are the main functionality of conversational AI for banks?

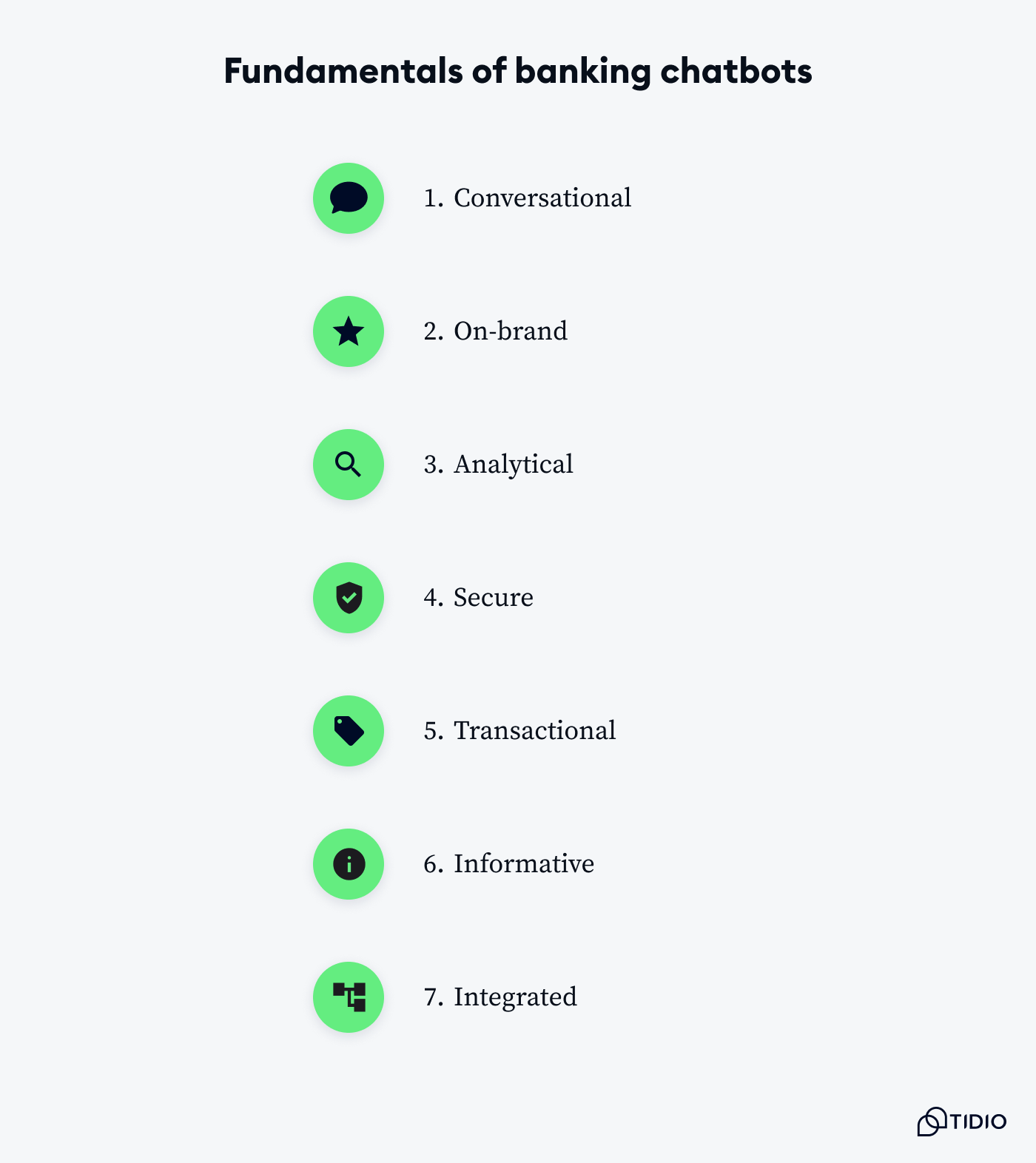

Fundamentals of banking chatbots

Digital banking boosts customer engagement and convenience. Many clients prefer online banking and self-service options thanks to the fast responses and seamless resolution of issues. But for that to be possible, bots need to have the essential functionality in place.

Effective and efficient conversational AI for banks should encompass several core components, including:

1. Conversational

At its basic level, your AI chatbot banking must be conversational. It should imitate human communication in syntax, grammar, and punctuation, ensuring customers experience a natural interaction.

Without this personalized touch, users may become frustrated, leading to a poor experience. Fortunately, most chatbot platforms utilize natural language understanding to foster human-like conversations.

2. On-brand

Your chatbot is an extension of your company and should reflect your branding accurately. This includes being well-versed in your policies regarding late fees and due date as well as using your brand voice to communicate with users.

Inaccurate back-end training could result in the dissemination of incorrect information, leading to a mismatched brand image and confused customers. So, ensure all necessary back-end information is up-to-date and accurate before launching your online banking virtual assistant.

3. Analytical

Chatbots should offer more than basic question-answering capabilities. Your conversational AI for banking needs an analytical component to effectively utilize cross-sell and upsell strategies.

It should be capable of collecting information and generating reports for your management team to analyze. Moreover, the continuous stream of analytical data provided by your chatbot can enhance your competitive advantage in offerings and services.

4. Secure

The transmission of information between your chatbot and customers must be secure. Chatbots often handle sensitive details such as customer addresses and account numbers.

To mitigate risks, it’s essential to choose a chatbot that operates independently of third-party providers. By processing and hosting data within the chatbot platform itself, you minimize the potential for unauthorized access to sensitive customer information.

5. Transactional

Implementing a conversational AI for banking should yield cost-saving opportunities by reducing the workload on live customer service agents. When evaluating banking chatbot platforms, consider the anticipated cost savings.

Then set benchmarks and routinely compare them with actual results. If there’s a significant disparity between your expectations and the outcomes, it may be time to re-evaluate and finetune your chatbot’s functionality.

6. Informative

One essential capability your banking chatbot must have is the delivery of valuable information. Responses should be tailored to specific queries or customer needs rather than providing generic answers.

For example, if a customer asks about their credit card bill due date, a vague response like “Bill due dates vary based on when your credit card was opened” is unhelpful. Instead, the chatbot should provide precise and accurate information, such as “Your bill is due on May 15.”

7. Integrated

Your banking chatbot should function as a seamless extension of your mobile app or website, rather than redirecting customers to a separate portal. For customers, switching to a different platform can raise concerns about the chatbot’s legitimacy.

Integrating your chatbot into your existing tech ecosystem allows it to access key resources, such as your customer support and knowledge databases, thereby providing valuable and cohesive information to your users.

With that out of the way, let’s have a look at some tips and best practices.

AI chatbots for banking: best practices

Businesses need to think about many details when choosing and implementing their bots. Operational costs, AI technology, and security are just some of the concerns. And with ever-growing customer expectations, adding a virtual agent to your services might become tricky.

So, let’s make it a little bit easier on you—here are five tips and best practices for implementing a banking AI chatbot:

Ensure security and compliance

Banking chatbots handle sensitive customer data and financial transactions, making security and compliance with regulations a top priority. Therefore, you should implement strong authentication mechanisms, such as multifactor authentication, biometrics, or secure messaging channels. Ensure that the software adheres to data privacy regulations like GDPR and PCI-DSS standards for handling financial information.

Integrate with existing systems

Seamless integration with the bank’s core systems is crucial for the chatbot to function effectively. These platforms may include account management, transaction processing, and customer relationship management (CRM) systems. The integration allows the chatbot to access and update customer information, initiate transactions, and provide personalized services.

Prioritize natural language processing

Invest in advanced natural language processing (NLP) capabilities. This will ensure that the chatbot can accurately interpret customer queries, handle complex conversations, and provide relevant responses. Continuously train and improve the models with real-world interactions.

Offer omnichannel support

Deploy the banking chatbot across multiple channels, such as mobile apps, websites, voice assistants, and messaging platforms like WhatsApp or Facebook Messenger. Multichannel customer service ensures that customers can interact with your company through their preferred communication channels, providing a consistent and seamless experience.

Implement continuous improvement and feedback loops

Regularly analyze customer interactions with the chatbot, identify areas for improvement, and update the chatbot’s knowledge base as well as flows accordingly.

Incorporate user feedback and sentiment analysis to enhance the chatbot’s capabilities and overall user experience. Continuously train and finetune the chatbot’s machine learning models with new data to improve its performance over time.

Additional chatbot best practices include providing fallback options for human assistance when needed, offering multilingual support for a diverse customer base, and ensuring accessibility for users with disabilities. By following these best practices, banking institutions can successfully implement chatbots that deliver efficient, secure, and personalized experiences to their clients.

Chatbots in banking industry: key takeaways

Banking chatbots have emerged as a powerful tool for financial institutions to enhance customer experience, streamline operations, and drive digital transformation.

By following best practices like ensuring robust security, seamless integration with existing systems, and prioritizing NLP, banks can maximize the benefits of chatbot implementation.

As a quick recap, here are the leading platforms in this sector:

- Tidio

- TARS

- IBM Watson

- Kasisto

- Haptik

- Kore-ai

As the technology continues to evolve, chatbots for banks and financial services are poised to play an increasingly crucial role in shaping the future of financial services.

Why not test one of them today?

FAQ

Banking chatbots are virtual assistants designed to interact with customers on various channels. They’re usually powered by AI and other technology, but rule-based bots also operate in banking services. These systems perform simple tasks and answer frequently asked questions automatically, without involving the customer support agents.

Yes, it does. The name of the chatbot is Erica, and it facilitates real-time conversations with the users.

To make a banking chatbot:

1. Log in to your chatbot platform

2. Go to the chatbots tab

3. Click Create from scratch or choose a template

4. Customize the flows according to your needs

Banking chatbots can handle simple tasks and repetitive questions. These include queries about due dates, pending payments, and balance statements as well as various reminders. However, it does not give financial advice to users.

Conversational banking is the use of AI and machine learning to empower bots to learn from past experiences, understand natural language, and respond in a human-like manner. This results in more engaging interactions and higher customer satisfaction.